Oracle HCM Update 24D: Payroll

High Impact

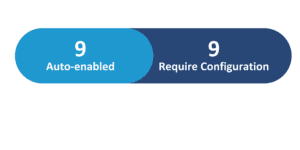

Feature Enablement

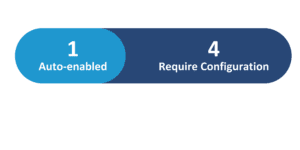

Redwood Features

24D Update Features Covered:

- Redwood Experience

- Payroll Activity Center Redwood User Experience

- Age Catch-Up Deferrals and Limit Enhancements

- Download Payslips

- Tax Withholding Card for Pending Workers

1. Redwood Experience

Redwood features are continuing to be introduced for Global Payroll, this time for viewing flows, Checklists and Costing Results. Redwood Experience is available for Payroll Activity Center which is action-focused payroll hub that’s tailored to individual roles and responsibilities. Canada is auto enabled with Tax Credit Information for Employee Self-Service.

2. Payroll Activity Center Redwood User Experience

Quick Notes:

This Payroll activity center allows you to quickly identify and resolve payroll errors to help ensure your employees are paid accurately and on time. With this single view of payroll across global operations, proactive alerts, and the ability to take quick corrective actions. Payroll Activity Center lets you monitor your payroll across each milestone (such as Payroll Calculations, Payments, Payslips and Accounting) in the payroll cycle. This ensures that all employees with a payroll calculation are paid, payslips are issued, and all payroll costs are transferred to subledger accounting.

3. Age Catch-Up Deferrals and Limit Enhancements

Quick Notes:

This enhancement allows deferred compensation plan catch-up limit to comply with the latest SECURE 2.0 Act changes. As of January 1, 2025, the age catch-up deferrals allowed for employees who are of age 60 through 63 is increased to a higher limit.

4. Download Payslips

Quick Notes:

This new standalone Download Payslips flow allows to view and download payslips of one or more employees. This flow enables you to download previously generated payslip PDFs that are held in the Document of Records. This is a standalone flow task, and you can’t use it in a custom flow. After you run the flow, the payslips are available as a zip file for downloading.

5. Tax Withholding Card for Pending Workers

Quick Notes:

This feature enables to define a person’s Tax Withholding card before their hire or start date. When enabled, the Hire a Pending Worker process automatically creates a Tax Withholding calculation card when you onboard the applicant. It includes a default Federal component. You can update this card with federal and state withholding details.