Oracle ERP Update 24C: Financials

Medium Impact

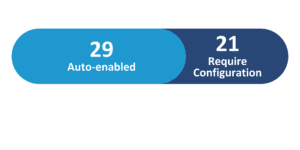

Feature Enablement

24C Update Features Covered:

- Budgetary Control at the Project Task or Lowest Resource

- Invoice Creation for Remitting Escheated Payments to Escheatment Authority

- Proration of Freight and Miscellaneous Lines for IDR Invoices

- Lease Classification in Primary and Secondary Ledgers

- Lease Payables Invoice Processing

1. Budgetary Control at the Project Task or Lowest Resource

Budgetary control at the task level provides detailed level spending control. For example, control the budget for each phase of the project, where a top task represents a phase of work with its own distinct budget. For each task, optionally add budgetary controls for each type of cost, such as controlling labor costs or supplier costs. The resource breakdown structure (RBS) allows for further granular control.

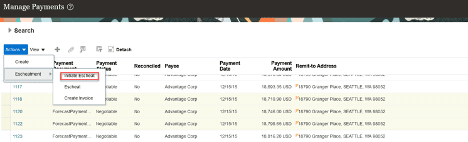

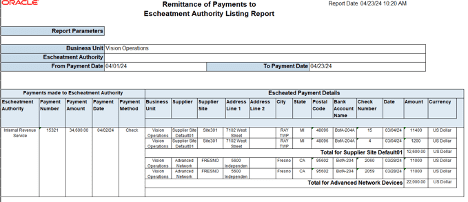

2. Invoice Creation for Remitting Escheated Payments to Escheatment Authority

Quick Notes:

Escheatment is a legal process in which the government takes control of assets unclaimed for a long time. 24B supported the identification and selection of stale payments, initiating escheatment, escheating the stale payment, and creating the related accounting. 24C automates the invoice creation and transfer to the escheatment authority.

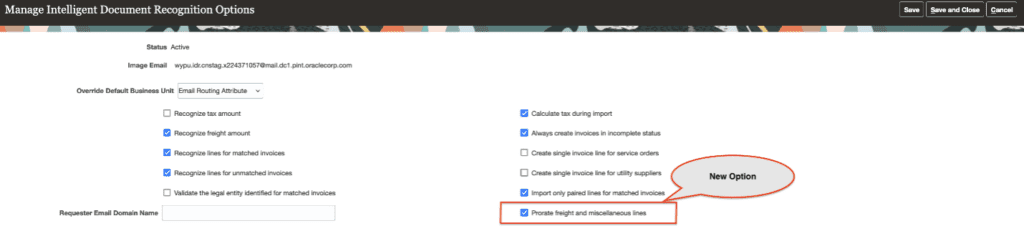

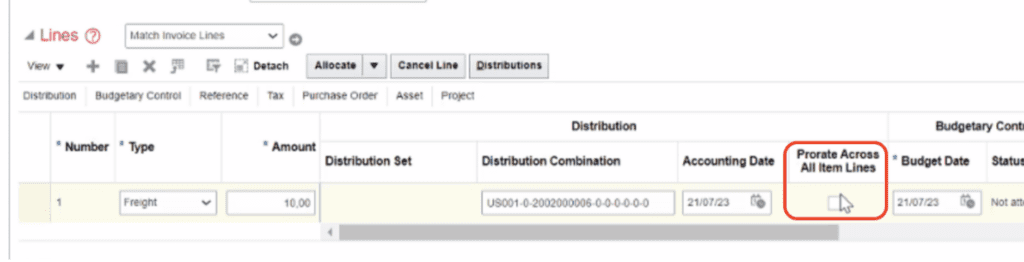

3. Proration of Freight and Miscellaneous Lines for IDR Invoices

Quick Notes:

Before 24C, for invoices imported using Intelligent Document Recognition (IDR), freight and miscellaneous amounts are recognized and prorated across item lines. In certain countries, the tax treatment varies between the item liability account and the freight account. In these cases, manual intervention is required to back out the prorated amounts in the item lines and assign those amounts to their dedicated accounts.

This feature reduces that manual effort by providing the option to assign freight charges to a specific account.

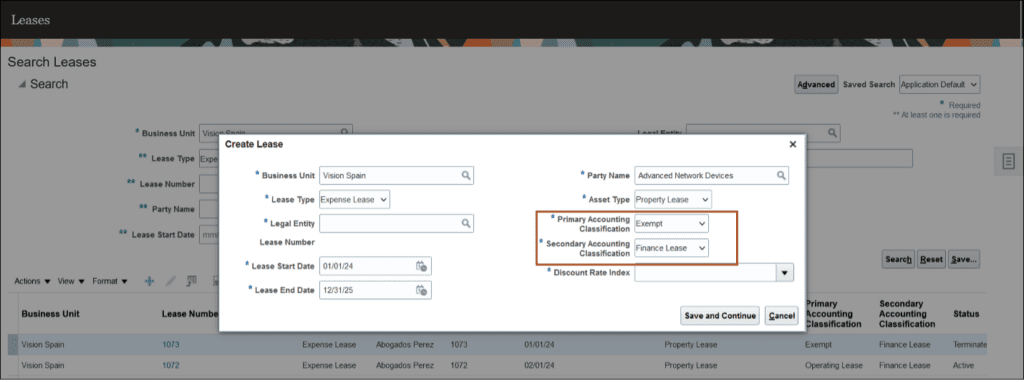

4. Lease Classification in Primary and Secondary Ledgers

Quick Notes:

Classify and account for leases differently under different accounting standards. With 24C, you can allow multinational organization lease administrators to generate accounting for a lease as a compliant lease, classified as either a Finance or Operating lease in the primary ledger under one GAAP, and as an exempt lease in the secondary ledger under another GAAP.

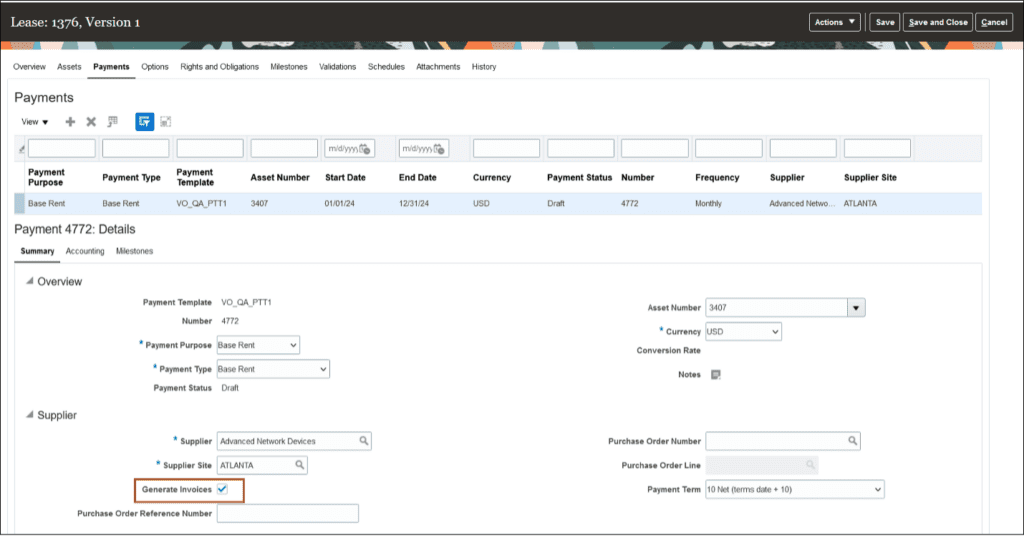

5. Lease Payables Invoice Processing

Quick Notes:

Lessees often work with lessors who create their own invoice and send it to the lessee to receive payment. Lessees then make payments against the supplier invoice instead of generating a self-billing invoice.

Lease administrators can use the Generate Invoices checkbox in the Create Expense Payment Template and Update Payment Details pages to control the automatic creation of Payables invoices for lease payments.

- Reduce effort to pay suppliers and lessors for lease related charges.

- Increase control over invoice generation and payments to lessors through integration with the Oracle Payables module.

- Expedite payments and reduce late fees by paying against the supplier-provided invoice

Note: This feature will be automatically enabled starting with 25A